Condo Insurance in and around Weslaco

Townhome owners of Weslaco, State Farm has you covered.

Cover your home, wisely

Your Search For Condo Insurance Ends With State Farm

When it's time to unwind, the home base that comes to mind for you and your family and friendsis your condo.

Townhome owners of Weslaco, State Farm has you covered.

Cover your home, wisely

Put Those Worries To Rest

Home is where your heart is. You need condo unitowners coverage to keep it safe! You’ll get that with Condominium Unitowners Insurance from State Farm, a trusted provider of condo unitowners insurance. Victor Reyna is your dependable State Farm Agent who can present coverage options to see which one fits your precise needs. Victor Reyna can walk you through the whole coverage process, step by step. You can have a no-nonsense experience to get coverage options for everything that's meaningful to you. We’re talking about more than just protection for your home gadgets, linens and clothing. You'll want to protect your family keepsakes—like collectibles and souvenirs. And don't forget about all you've collected for your hobbies and interests—like cameras and musical instruments. Agent Victor Reyna can also let you know about State Farm’s great savings and coverage options. There are savings if you carry multiple lines of State Farm insurance or have an automatic sprinkler system, and there are plenty of different coverage options, such as personal articles policy and even additional business property.

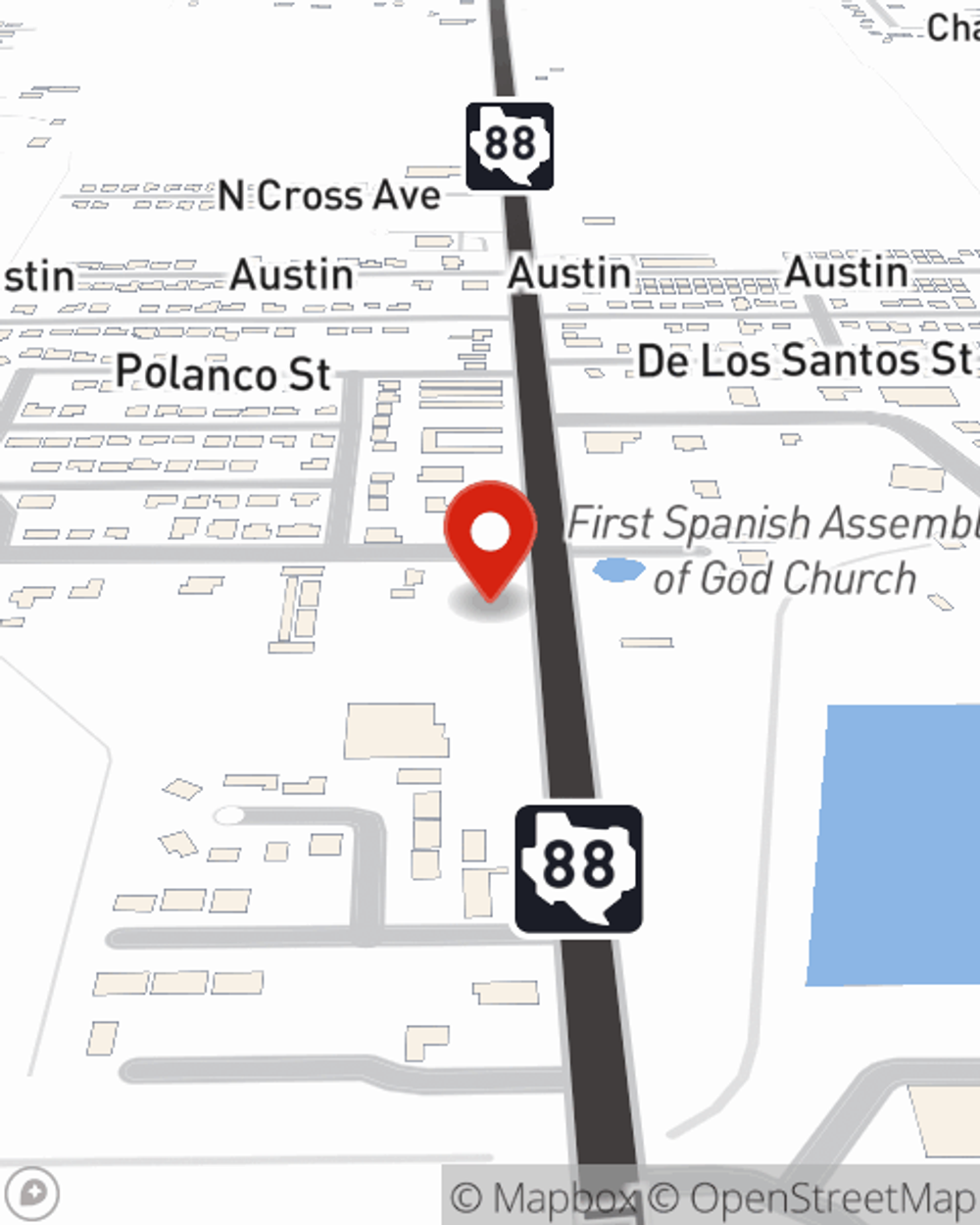

When your Weslaco, TX, condominium is insured by State Farm, even if something bad does happen, State Farm can help insure your one of your most valuable assets! Call or go online now and see how State Farm agent Victor Reyna can help you protect your condo.

Have More Questions About Condo Unitowners Insurance?

Call Victor at (956) 272-1010 or visit our FAQ page.

Simple Insights®

Portable moving pods: A new approach to moving

Portable moving pods: A new approach to moving

Portable moving pods can offer new advantages for the moving process. Decide what’s easiest and cheapest for you.

Plumbing maintenance tips

Plumbing maintenance tips

Home plumbing problems can cause major damage. Performing a home plumbing checkup regularly can help to avoid plumbing issues. Read more tips.

Victor Reyna

State Farm® Insurance AgentSimple Insights®

Portable moving pods: A new approach to moving

Portable moving pods: A new approach to moving

Portable moving pods can offer new advantages for the moving process. Decide what’s easiest and cheapest for you.

Plumbing maintenance tips

Plumbing maintenance tips

Home plumbing problems can cause major damage. Performing a home plumbing checkup regularly can help to avoid plumbing issues. Read more tips.